Iress defensive revenue

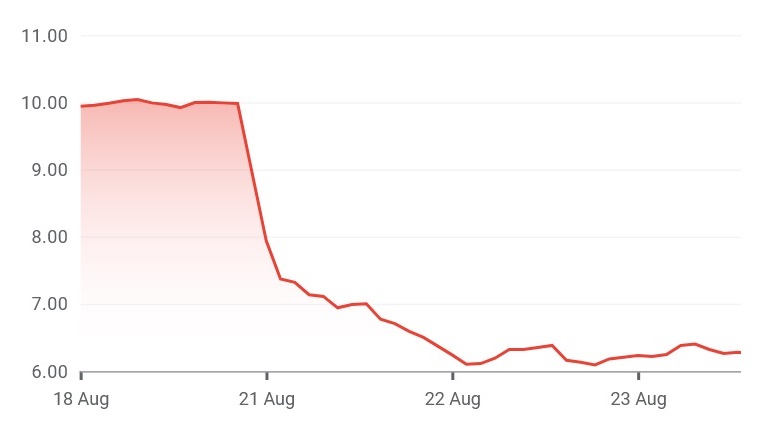

In response to Iress’ large fall in share price on 21 August 2023, in the article “Iress update likely to attract buyer interest” 1, Bridget Carter discusses the possibility of a private equity buyer purchasing Iress.

She ends the article with:

Buyout funds are thought to be attracted to Iress for its high cashflow, defensive revenue and underperforming assets.

My interpretation of this sentence is that Iress has little competition in their capital markets space and can maintain or increase pricing. There are other companies - such as Motif Markets - with products that compete with Iress in the brokerage services space. Potentially they could provide pricing competition and bring lower prices to brokerage firms. However Iress’ strong brand presence amongst brokers is a formidable barrier to entry.

When Paritech was directly competing against Iress, a constant issue for Paritech was that brokers were more interested in having the best product - irrespective of price - and the status that comes with the Iress brand. Value for money was a low priority.

Motif Markets continues to further develop and refine its brokerage platform. However currently we are focused on our exchange and our overseas customers. However our trading platform is fully compatible with the ASX and we are ready to provide our services to Australian brokers who are interested in innovation at an affordable price.

-

Article in The Australian - Subscription required ↩︎